China's continued stratospheric economic rise appears inevitable. However, that rise is not guaranteed.

A useful comparator is Japan in the 1980s during the height of the Japanese economic miracle. Fueled by free flowing money that was directed into its keiretsus (eg Toyota, Honda, or Mitsubishi) and formerly into its zaibatsus (giant monopolies) by the all-powerful Ministry of International Trade and Industry (MITI) Japanese tech ruled the world. Its banks were the largest in the world; its international corporations were the most successful (32 of the top 50 worldwide); and its real estate and stock market soared sky high.

Japan was at the apex of its technical prowess. Tokyo real estate was the most expensive in the world; The keiretsus like Sony were on buying sprees planetwide scooping up major properties like Hollywood icon Universal Studios. Japanese real estate developer Minoru Isutanit bought California's renowned Pebble Beach golf course, and in 1989 the Mitsubishi Group bought New York City's Rockefeller Center.

As a rising star in the AI firmament, I was invited to Tokyo twice for presentations. The second time, while staying at the New Otani Hotel, I was called to the lobby where I was greeted by dozens of reporters with flashing lightbulbs and handed $3,000 in a cash prize. (My AI research at Stanford on automated discovery was what the fuss was all about.)

The Japanese had a laser focus on AI, computer science, and robotics and their universities and corporations, fueled by MITI's funds, were pursuing tech supremacy with a vengeance.

But, as we know, in the 1990s, it all came crashing down and never recovered. So, what happened? The details are here, but I'll cut through the economic gobbledy-gook.

They ran out of money. The economic bubble was inflated by funny money. That money sloshed into Tokyo real estate and corporate coffers. It fueled investments and projects that didn't pan out. When the debt ballooned, their stock market crashed, and the central bank was not able to save it. Interest rates have been at zero for more than a decade. The current Japanese debt to GDP is 240%. )

So, is China's rise to world domination inevitable? Absolutely not.

Let's start with parallels to the Japanese bubble and its subsequent rapid bursting.

Chinese Debt: Most relevant, China's debt to GDP ratio is bursting at the seams: 317%. Note: this is larger than Japan's and even larger than that of the free-spending USA at a mere 98%. Since the US dollar is the reserve currency of the world and (with non-zero treasury rates ) everybody is willing to bid up the dollar and loan money to the US — even our "friendly rival" the PRC holds three trillion dollars and one trillion of US debt. End Game of China describes the fragility of China's banks and the likelihood of a full-blown meltdown. Another possibility is an economy largely decoupled from the world's (a la North Korea.) Unsubstantiated claims of lesser figures for China's debt to gdp ratio are likely fallacious and don't account for opaque off-balance sheet items (eg debts of state-owned enterprises) in a totalitarian nation. Also, see discussion of Chinese debt to GDP under Correspondence.

See all those new skyscrapers and bullet trains in China. Ask yourself why Lichtenstein or Chad doesn't have them. The answer is money. (Of course, that's not the only answer.)

If money is invested optimally — in the most productive, growth-promoting assets — then a rising tide may indeed float all boats.

By emulating the West it appears that the PRC under Deng Xiaoping followed a highly productive path. It built power plants, roads, trains, factories, office buildings, and it subsidized corporations that built critical products to support industrialization and a first-world, export-based economy.

That worked wonders. But now that the money printing press is still in high gear, the investments may be less productive. Here are a few examples. (See China's Risks and Challenges from KJ Reports.)

Ghost Cities: These are cities with dozens of high rise apartments with no residents. They are built with cheap, low quality materials and sold merely as prestige investments to wannabe rich, middle class speculators. These cities have no industries to support employment. Renters don't want to live in a place where there's no work nor amenities. See 60 Minutes Australia: Inside China's Ghost Cities; or see Exploring an Abandoned Chinese Ghost City.

Massive Mega-Cities: Jingjinji: Beijing is targeting several new locations to build out cities of 100 million people. The prime example is Jingjinji. This is the ultimate in central planning and could run amok in just the same way that Mao's Great Leap Forward was disasterous. If a city grows organically, it's because housing, employment, and amenities grow hand-in-hand.

A comparator to Jingjinji is the proposed Saudi Arabian mega-city, Neom. This is the dream of the all-wise, all-powerful Prince Mohammed bin Salman. It was having funding and political problems even before the hit job on Jamal Khashoggi (and other attempts at control from on high.) That has made foreign investors gun shy.

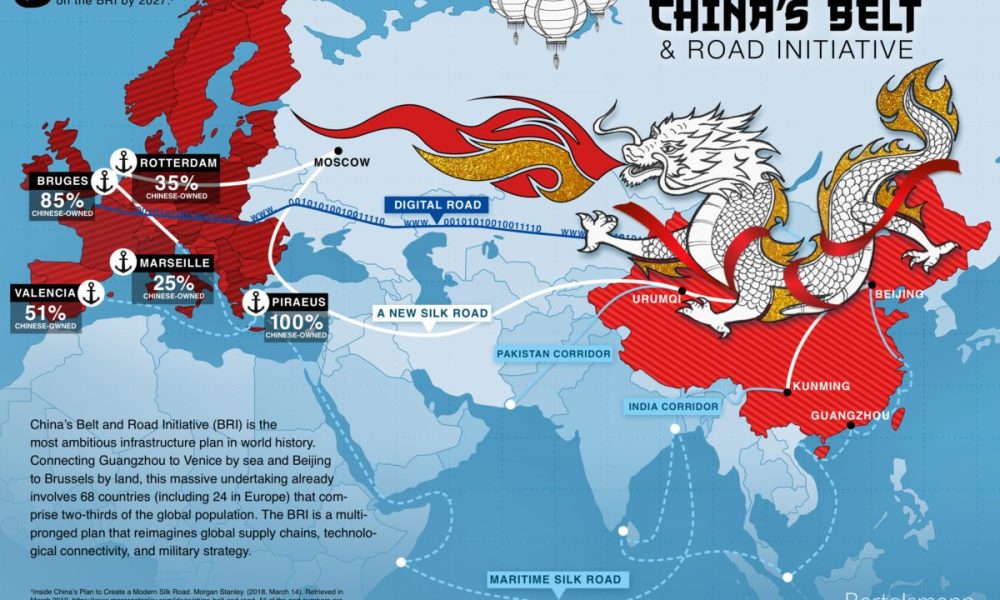

Bridges to Nowhere: This is a catch-all term for useless infrastructure, often the result of lavish government spending on centrally planned projects. The BRI, Chairman Xi's latest mega-project, may outdo all others on this dimension.

The BRI: Belt and Road Initiative: This is a huge multi-trillion dollar project spanning not only Eurasia but also Africa and Latin America. Confusingly, the Belt portion refers to roads and train lines whereas the Road portion refers to sea lanes and ports. BRI is well covered elsewhere. I bring it up because, it's a prime example of huge investment directed by central planning on infrastructure that may prove to be destructive of Chinese capital or useless debt traps for recipients .

Chinese corporations are also racking up massive debt. Even when subsidized heavily or outright owned by the Party, as with state-owned enterprises, somebody needs to pay the bill. Analogous to Sony's wild spending spree on Universal Studios in the 1980s, in 2016 Chinese corporation Zhonghong Zhuoye bought a controlling interest in San Diego-based SeaWorld. As the corporations debt soared by four times, it was subsequently delisted from the Shenzhen stock exchange. (See End of the Chinese Miracle by Financial Times, 2016 )

Competition with Other Rising Low Cost Producers: Manufacturing for world markets has been the lifeblood of the Chinese economy. That could hit several snags. As wages rise, it may be cheaper for foreign manufacturers like Apple to move their production to other countries. This trend accelerated in 2020 during the Covid pandemic as companies sought to diversify and harden the reliability of their supply chains. Foreign manufacturers are relocating some factories to India or to some of the ASEAN countries, eg Indonesia, Thailand, and Vietnam.

Middle Income Trap: This describes a country in which per capita GDP has risen to a middle income level in which manufacturing is no longer cost-effective but beyond which a country cannot rise because of lack of advanced engineering capabilities. (Actually, lack of engineering talent won't be a factor in China's case.)

A related, slow rolling worry is the graying of the Chinese populace. Almost no tech talent immigrates into China - why would they? But, there's a massive brain drain and money drain as talented engineers and the rich seek more secure locations in the West to seek and to hold onto their fortunes.

Surveillance State: The increasingly centralized control of information behind the Great Firewall and the illegality of VPNs (virtual private networks) has made information dissemination problematic. This could contribute to a slowing of innovation and a dampening effect on original entrepreneurial initiatives not favored by the Party.

Poverty Alleviation: While the entrepreneurs and super-rich of China's east coast make all the headlines, most citizens are still well below America's poverty line of $18,000 per year for a family of four. When the PRC says they've lifted 800 million out of poverty, they are referring to a threshold of about $500 per year. These are peasant farmers who live hand to mouth and are frequently crushed by disease, bad weather, crop failures, or capricious central planning.

To their credit Beijing has recently undertaken expensive programs to help alleviate poverty in the countryside via cash payments, gifts of cows or sheep, home renovation, and support for education, health, and infrastructure. However, these program are not cheap. It's estimated that the PRC will spend 1% of its GDP over the next five years to support this. Poverty alleviation is expensive; so is the BRI, and so was the Chang-E 5 lunar lander. It's great if you can do all three, but somehow you have to pay the bills.

Responding to a variety of misdeeds and aggressive actions, President Trump declared a trade war on the PRC responding to the PRC's massive state subsidies, its currency manipulation, its IP theft, and its asymmetric thwarting of American corporations. There has also been widespread condemnation of the CCP's crackdown on Hong Kong, its militarization of islands in the South China Sea, its confrontation with India, and its aggressive build up of the People's Liberation Army.

Perhaps the most damaging move in the trade war was our May, 2020 embargo of the sale of computer chips and chip making equipment from any of our allies to Chinese corporations that support the PLA — most notably Huawei. (I discuss this in detail here.) China's saber-rattling is not endearing any of its near neighbors who in 2020 watched peaceful freedom demonstrators in Hong Kong get crushed. The Party's imprisonment of millions of Uyghurs in Xinjiang has alienated liberal democracies worldwide. China's political allies are a rogue's gallery of backward, authoritarian states: eg, Russia, Iran, and Venezuela. At minimum this is a public relations disaster for a country trying to encourage reluctant investors to part with new direct investments or to partner with China's Belt and Road. Newly elected President-designate Joe Biden's policies are unlikely to depart substantially from Trump's. Moreover, it's likely that Biden will join forces with our allies to press Beijing on issues of asymmetric market access and human rights.

Japan managed to become crippled in the 1990s even without the self-inflicted PR minefield that China has stirred up in the West.

Building infrastructure in America invariably requires years of study to assess consequences and extensive EIRs (environmental impact reports.) These regulations may cause large projects to roll out at a glacial pace or to be stillborn. The "poster child" of this aspect of American development is the Yucca Mountain Nuclear Waste Repository proposed in 1987 and all but abandoned in 2020. This was to serve as America's one and only long-term storage facility for nuclear waste. The abandonment of this repository is a crucial factor in our having virtually terminated efforts to expand US nuclear power. Thus, a promising major energy source of non-CO2 generating power has been foreclosed despite promising new, safe nuclear reactor designs.

A second, oft-cited example of the difficulty of undertaking large infrastructure in America is the decades long, massively over budget construction of a high speed rail line between Los Angeles and the San Francisco Bay Area. This project has been stalled by the difficulty of obtaining easements and by environmental regulations (among many factors.)

These examples may sound like a win for the Chinese system of authoritarian control of land use and they are. However, China's economic miracle has been accompanied by massive pollution of its water, air, and land. This has already taken a toll on the health of the nation and its ability to produce healthful food. The maniacal drive by the PRC for growth at any cost, reminiscent of the mercantilist nineteenth century American Gilded-Age (of steel and railroads,) has produced a seemingly paradoxical mixture. China is simultaneously the world's leading producer of solar panels and wind turbines while at the same time continuing to build megawatt coal-fired power plants on its own soil and on that of its BRI national partners. This "externality" may slow down China's growth as its destructive effects are brought onto its balance sheets.

Here I've briefly presented some factors that may slow or derail China's meteoric rise. Elsewhere in this series of essays, I've discussed factors that work in China's favor, eg its five million strong annual crop of hard-working science and engineering graduates, its long-term planning horizon, its meritocratic command economy, its ability to evade all constraints on use of property for state purposes (eg as in the eviction of millions of peasants when the Three Gorges Dam was built,) its relentless ability to acquire technical designs from the West by whatever means, and its massive state subsidies for targeted research priorities.

Only time will tell how these factors play out.

Three Gorges Dam

: 22 Gigawatts of Power; a Million Residents DisplacedI welcome substantive comments on all my articles. With your permission I may include excerpts. You can post here anonymously, but to do so you should have a verifiable identity, eg a website, Linked-in ID, or Facebook page, etc. Mail comments to bob AT bobblum DOT com (with the usual syntax.)

16 Jan 2021: Initial draft uploaded.

(Substantive comments may be emailed to bob AT bobblum DOT com. With your permission excerpts may be posted here.)

16 Jan 2021: Debt to GDP of China: The denominator (China's GDP) is approximately 14 trillion dollars and seems to be widely agreed upon. The numerator (China's debt) appears to be more contentious. Obviously, it depends on which debt obligations are included.

A portion of the complexity arises from the major structural differences between the governments of China and the US. Simply put, the PRC is ultimately responsible for not only its nomimal sovereign debt but also the debt of its massive SOEs (State-Owned Enterprises) as well as the debt of the provinces. This is further complicated by the PRC's owning all the land, nominally owned by localities. The localities have been selling this off at inflated prices to cover their own debts.

This diffusion of debt (and accounting practices that obscure it) led both Moody's and S&P to downgrade China's sovereign debt in 2017 (per New York Times.) These downgrades and intricacies are also discussed here: South China Morning Post 2020 and in KJ Reports. Also see Dollar Liquidity Crisis: End Game for China (with Macrolens chief strategist Brian McCarth in 2019.)

In the US if California or its electricity provider PG&E were to go broke, the US would not be on the hook for those debts. Of course, the massive debt of the US has not gone unnoticed. The current published US national debt is $27.8 trillion. Particularly nettlesome are the unfunded obligations of the US due to entitlements (Social Security and Medicare.) Adding it all up yields a debt of $138.7 trillion!

Thanks to Rich S and to Stu K for their research and comments on this issue.

16 Jan 2021: A reader comments:

Re: Trump’s motives for the trade war with China, I didn’t think Human Rights issues like Hong Kong played a large part. In fact a member of one of Trump’s China travel delegations intimated that Trump as much as offered to ignore HK if China would support his re-election campaign. I thought his motives were much more dollar driven but this is just memory and yours is certainly better than mine. I think we all agree that his attack on IP pirating was long overdue and I certainly give him credit for that.

I was surprised to see Yucca Mountain mentioned as a key driver of the decline of nuclear. You’re undoubtedly right but I always thought it was the other way around. I always thought it was public outcry following disasters like Three Mile Island that spelled the end for a decade or two. A huge shame I always felt.

15 October 2022: One of my favorite YouTube journalists is Dagogo Altraide, who presents comprehensive reviews on his channel, ColdFusion. Today he features a great review: China's Economy is in Bad Shape. This is just in time for the CCP's 20th National Party Congress. Xi Jinping will be re-annointed for an unprecedented third term. (My joke is that Xi's monumentally bad decisions have lessened his chances from 100% down to 99.9%.)

7 April 2024: China's Real Estate Collapse Has Only Just Begun: this is a spectaculary good analysis and summary of China's economy by macro-economist Brian McCarthy. Basically, absolutely everything in the PRC is paid for directly or indirectly via China's central bank, which (similar to the US but on a far grander scale) just keeps printing money to pay for everything: real estate, infrastructure, Belt and Road, and tech development. I love his quote: "a rolling loan gathers no loss." (until it doesn't.) China is one giant Ponzi scheme. They've got 100 million paid for but unfinished apartment units, for example.

There may be one upside to Xi Jinping's printing trillions of yuan to support the manufacturing of millions of electric vehicles. The atmosphere (and global warming) doesn't care whether the cars are made by Geely and BYD or by Ford and GM (or by Tesla). There just needs to be fewer gas guzzlers.

(Substantive comments may be emailed to bob AT bobblum DOT com. With your permission excerpts may be posted here.)